Tuesday, June 30, 2009

The Importance of Sympathy

Brad DeLong is once again beside himself. Sometimes the lies of the free market economists are so incredible that even he is surprised:

DeLong then uses his (and Krugman's) favorite blogoffect--"Ummm..."--to first stun his opponent, then he moves in for the Reality-Based kill:

Just to make sure we get it, DeLong says of the above table:

I am not defending what Sowell wrote in that column; the idea that the U.S. is going to be conquered by Islamists is silly. (Conquered by Marxists, now you're talking...) But c'mon Prof. DeLong, he obviously meant "deficit" and not "debt." A friendly suggestion: Spend less time wondering "why oh why is everyone else so stupid and evil?" and try to understand what your opponents are actually saying. It's just possible you are wrong on one or two issues of importance.

Does National Review have no editors? Does Thomas Sowell have no friends?Wherefore this personal attack on a disadvantaged minority? Sowell's mistake was the following line from a National Review article:"A quadrupling of the national debt in just one year... [is] not [a thing] from which any country is guaranteed to recover..."

DeLong then uses his (and Krugman's) favorite blogoffect--"Ummm..."--to first stun his opponent, then he moves in for the Reality-Based kill:

Just to make sure we get it, DeLong says of the above table:

The national debt is estimated to be likely to increase by 17% in nominal terms over fiscal 2010. It is not estimated to quadruple. Is there nobody at National Review who will tell Sowell that +17% is not equal to +300%?I'm going to go out on a limb and guess that Thomas Sowell already knows that 17% is not equal to 300%. (I have omitted DeLong's signs for brevity.) In fact, looking at the very same table, I can come with a much more plausible explanation for Sowell's mistake.

I am not defending what Sowell wrote in that column; the idea that the U.S. is going to be conquered by Islamists is silly. (Conquered by Marxists, now you're talking...) But c'mon Prof. DeLong, he obviously meant "deficit" and not "debt." A friendly suggestion: Spend less time wondering "why oh why is everyone else so stupid and evil?" and try to understand what your opponents are actually saying. It's just possible you are wrong on one or two issues of importance.

Murphy on Fox News

On Friday, June 26, 2009 I had a brief appearance on Stuart Varney's show. (Here is the clip from June 26, 2008 when I was also on his show.) In case you're wondering, I wasn't being thoughtful in between questions; there is a slight delay.

What's Wrong With This WSJ Snapshot?

Von Pepe sends along the following screen shot. Notice anything ironic about the two circled stories?

Austrians: Our Victory Is Complete, Part II

In an earlier post, I quoted Scott Sumner who (jokingly) said that ABCT had captured the hearts and minds of the intelligentsia. Today I impulsively followed a Google Ad (from my inbox, not from this blog, which would violate all sorts of contractual provisions) to this in-your-face site, which declares:

Perhaps you are not convinced? Okay, check out this money quote: "Compared to the Great Depression of the 1920's, sometimes, it seems that little has changed."

Beautiful! They realize with the Austrians that it was the unsustainable credit expansion of the 1920s that was the true disaster. Other observers try to figure out what went wrong, starting with the 1929 crash, and then focusing on the 1930s. Not these guys. Bravo!

At the end of the day, we are not dependent on the wealthy. We are not dependent on the lawmakers, the banks, or the government to turn the tide. We are dependent on ourselves. We are the only ones who are going to save us from this "recession."So already you can see the Austrian influence. Notice that they contrast "lawmakers" with "the government," showing that they are aware of Hayek's distinction between law and legislation.

Perhaps you are not convinced? Okay, check out this money quote: "Compared to the Great Depression of the 1920's, sometimes, it seems that little has changed."

Beautiful! They realize with the Austrians that it was the unsustainable credit expansion of the 1920s that was the true disaster. Other observers try to figure out what went wrong, starting with the 1929 crash, and then focusing on the 1930s. Not these guys. Bravo!

Avoid Hardee's of Valdosta #6

This is mostly a note to myself, but some of you who are in the Florida / Georgia area and who also patronize fast food restaurants may benefit as well:

On a recent road trip, I picked the wrong Hardee's. The floors were dirty, the shake machine was out of commission, the soda was flat, and they screwed up my order. (I had ordered my burger first, then I ordered my son's and asked them to hold the onions and pickles. They held the toppings on my burger as well.)

But to top it all off, after we got our food I wanted some ketchup. I went up to the condiments area, and the dispenser was empty. So I asked at the counter, and the lady said, "Sure thing, one moment."

She went in the back, and I thought she forgot about me, because how long could it take to grab a few ketchup packets? But a minute or two later, she came back with a little plastic bowl filled with ketchup. "We're still waiting to get our packets in," she explained.

Inasmuch as there are 10 Hardee's per square mile in this region of the country, in the future I will tough it out and drive past the Valdosta #6 Hardee's location.

On a recent road trip, I picked the wrong Hardee's. The floors were dirty, the shake machine was out of commission, the soda was flat, and they screwed up my order. (I had ordered my burger first, then I ordered my son's and asked them to hold the onions and pickles. They held the toppings on my burger as well.)

But to top it all off, after we got our food I wanted some ketchup. I went up to the condiments area, and the dispenser was empty. So I asked at the counter, and the lady said, "Sure thing, one moment."

She went in the back, and I thought she forgot about me, because how long could it take to grab a few ketchup packets? But a minute or two later, she came back with a little plastic bowl filled with ketchup. "We're still waiting to get our packets in," she explained.

Inasmuch as there are 10 Hardee's per square mile in this region of the country, in the future I will tough it out and drive past the Valdosta #6 Hardee's location.

More Rosy Forecasts From the CBO

Earlier I linked to an IER critique of the CBO's scoring of Waxman-Markey. Bob Roddis sends me this Yglesias discussion of the super bargain TARP plan. You thought taxpayers were out $700 billion? Nah, don't worry; the CBO is predicting only $159 billion in total losses on the plan, of which a mere $69 billion* is due to financial sector losses.

* It's a nice comment on the times that I actually typed the phrase "mere $69 billion."

* It's a nice comment on the times that I actually typed the phrase "mere $69 billion."

Cowen and Yglesias (!) Making Sense on Climate Change

Tyler Cowen approvingly quotes Matt Yglesias on the dangers of starting a carbon tariff war:

After quoting Yglesias, Tyler concludes:

Exactly, guys! How would we feel, and how would it influence our domestic politics, if Al Gore demanded we pass Waxman-Markey, while polluting at a high level himself, or otherwise armed men will throw us in jail?

Matt Yglesias is right: We don't need coercion to deal with climate change.

The bottom line about the international aspects of climate change is that the very idea of an effective response assumes the existence of a generally cooperative international environment. It doesn’t assume the non-existence of the odd “rogue” state here or there, but it assumes the absence of any kind of serious great power rivalries. Not just China, but also India and probably Russia, Brazil, and Indonesia as well are going to need to cooperate in a serious way with the OECD nations on this. And I just don’t see how you’re going to get where you need to get through coercion.

After quoting Yglesias, Tyler concludes:

I'll say it again: the current version of Waxman-Markey will make things worse. Keep in mind by the time we are slapping those 2020 tariffs on China, we won't have made much progress on emissions ourselves. How would we feel, and how would it influence our domestic politics, if the Chinese demanded we pass Waxman-Markey, while polluting at a high level themselves, or otherwise they will stop buying our Treasury securities?

Exactly, guys! How would we feel, and how would it influence our domestic politics, if Al Gore demanded we pass Waxman-Markey, while polluting at a high level himself, or otherwise armed men will throw us in jail?

Matt Yglesias is right: We don't need coercion to deal with climate change.

Monday, June 29, 2009

For the Record: The BLS' NSA CPI circa June 2009

In a recent post [link to be added], Robert Wenzel spelled out something that had been implicit in my views. I'll recapitulate the argument here, and then I'll list the BLS' current figures so we have a convenient record later on.

For a while I've been warning that actual Consumer Price Index (CPI) inflation has been much higher than the official, "seasonally adjusted" numbers that the media report. For example, if actual CPI rose by 0.3 percent in May, the BLS would adjust it down to a mere 0.1 percent, and the media would dutifully say, "Prices rose 0.1 percent last month, showing deflation threat still looms."

Now if the "seasonal adjustment" for the first six months is to push down prices below their actual rates of inflation, then by symmetry in the latter half of the year, the BLS will need to bump up the actual numbers and report higher inflation rates to the media. This is where I thought the hanky panky would come in.

In this context, Wenzel clarifies that by next year, obviously the BLS numbers for 2009 have to show the same annual rates of inflation, over the course of 2009. In other words, the "seasonal adjustments" for the year 2009 will have to cancel each other out, over the four seasons.

So in practice, when I say the BLS is going to cheat, what they will do is revise the "seasonal adjustments" from January through June 2009. For example, they will say," Upon further review, back in May, seasonally adjusted prices actually rose by 0.2 percent. Gosh it's too bad we told the media the lower figure of 0.1 percent at the time. Our bad."

In this way, they can keep the upward seasonal adjustments very tame, from July through December. If the actual CPI rises, say, by 0.7 percent in August, then the BLS will report it as either a straight 0.7 (i.e. no seasonal adjusmtent) or a 0.8 percent, even though they were bumping down the numbers by bigger margins in the first half of the year. But they're not going to want to report a 1.0 percent price hike, so they'll contain the monthly inflation number by dumping some of it back into earlier months.

=============

Let's take a snapshot of the two series before the predicted hanky panky ensues:

MONTH....NSA CPI....SA CPI

Jan 09.....211.143......212.174

Feb 09.....212.193......213.007

Mar 09.....212.709......212.714

Apr 09.....213.240......212.671

May 09.....213.856......212.876

For a while I've been warning that actual Consumer Price Index (CPI) inflation has been much higher than the official, "seasonally adjusted" numbers that the media report. For example, if actual CPI rose by 0.3 percent in May, the BLS would adjust it down to a mere 0.1 percent, and the media would dutifully say, "Prices rose 0.1 percent last month, showing deflation threat still looms."

Now if the "seasonal adjustment" for the first six months is to push down prices below their actual rates of inflation, then by symmetry in the latter half of the year, the BLS will need to bump up the actual numbers and report higher inflation rates to the media. This is where I thought the hanky panky would come in.

In this context, Wenzel clarifies that by next year, obviously the BLS numbers for 2009 have to show the same annual rates of inflation, over the course of 2009. In other words, the "seasonal adjustments" for the year 2009 will have to cancel each other out, over the four seasons.

So in practice, when I say the BLS is going to cheat, what they will do is revise the "seasonal adjustments" from January through June 2009. For example, they will say," Upon further review, back in May, seasonally adjusted prices actually rose by 0.2 percent. Gosh it's too bad we told the media the lower figure of 0.1 percent at the time. Our bad."

In this way, they can keep the upward seasonal adjustments very tame, from July through December. If the actual CPI rises, say, by 0.7 percent in August, then the BLS will report it as either a straight 0.7 (i.e. no seasonal adjusmtent) or a 0.8 percent, even though they were bumping down the numbers by bigger margins in the first half of the year. But they're not going to want to report a 1.0 percent price hike, so they'll contain the monthly inflation number by dumping some of it back into earlier months.

Let's take a snapshot of the two series before the predicted hanky panky ensues:

MONTH....NSA CPI....SA CPI

Jan 09.....211.143......212.174

Feb 09.....212.193......213.007

Mar 09.....212.709......212.714

Apr 09.....213.240......212.671

May 09.....213.856......212.876

More Bluffing From Krugman

This is great; sometimes I really just love the Internet. Paul Krugman shoots his mouth off about an Arrow article, and Bryan Caplan and then David R. Henderson spank him. Naughty Nobelist!

Such a public comeuppance is only possible with the Internet. I was pretty sure Krugman was bluffing about the Arrow paper, but I don't think I ever actually read it. Yet now anyone he cares to investigate will see Krugman was bluffing.

What's really funny is that I'm coming to realize just how much he bluffs. Whenever he touches an area that I know--such as the economics of climate change, or the Austrian business cycle theory, or the Herbert Hoover record--it jumps out at me how unfair Krugman is to his intellectual opponents, and how (seemingly willfully) misleading his arguments are.

But as I read others in their areas of expertise, I realize Krugman bluffs there, too. Please tell me he was at least really awesome in trade (where he got his "Nobel").

Such a public comeuppance is only possible with the Internet. I was pretty sure Krugman was bluffing about the Arrow paper, but I don't think I ever actually read it. Yet now anyone he cares to investigate will see Krugman was bluffing.

What's really funny is that I'm coming to realize just how much he bluffs. Whenever he touches an area that I know--such as the economics of climate change, or the Austrian business cycle theory, or the Herbert Hoover record--it jumps out at me how unfair Krugman is to his intellectual opponents, and how (seemingly willfully) misleading his arguments are.

But as I read others in their areas of expertise, I realize Krugman bluffs there, too. Please tell me he was at least really awesome in trade (where he got his "Nobel").

Glenn Greenwald Busts Hypocritical Obama Supporters

I am so glad that Glenn Greenwald has been consistent in his treatment of Bush and Obama. I loved his scathing critiques of the Constitution-chuckin' cowboy in the White House, but I was bracing for GG to come up with excuses for Obama (as so many have done). But not Glenn:

That is one of the most beautiful arguments I have ever seen in the political arena. He totally busted about 10 million people in this country. And I bet there are some of them who, if they read GG's post, would realize that was true of them, and yet they hadn't sensed any problem at the time. It all seemed so natural, and with Obama being picked on by that meanie Rush Limbaugh, one's inclination would be to defend him no matter what.

Ever since Obama reversed himself on the question of whether to suppress the torture photos, I've been searching for an Obama supporter who (a) defends his decision to suppress those photos but also (b) criticized him when, two weeks earlier, he announced that he would release those photos. I haven't found such a person yet, but I'm still looking.

When Obama originally announced he would release the photos, he was attacked on seemingly every television news show by people like Lindsey Graham, Liz Cheney and Joe Lieberman for endangering the Troops, but I don't know of a single Democrats who joined in with those criticisms on the ground that the photos shouldn't be released. But as soon as Obama changed his mind and embraced the Graham/Cheney/Lieberman position, up rose hordes of Obama supporters suddely insisting that those photos must be suppressed because to release them would be to endanger the Troops. I'm still searching for any pro-photo-suppression Democrats who criticized Obama when he triggered controversy by orginally announcing he would release them.

That is one of the most beautiful arguments I have ever seen in the political arena. He totally busted about 10 million people in this country. And I bet there are some of them who, if they read GG's post, would realize that was true of them, and yet they hadn't sensed any problem at the time. It all seemed so natural, and with Obama being picked on by that meanie Rush Limbaugh, one's inclination would be to defend him no matter what.

Update On My Erroneous Gold Call

Time is slipping away (busy busy busy), so let me put my finger on the single biggest mistake I think I made regarding my January 23rd call for gold to break $1000 by the summer.

First, let me give myself a break. At the time of the call, gold was about $878 (I'm just eyeballing the charts from Kitco, so I might be off a bit). Right now, gold is trading at about $942, using the same metric (London Fix).

So that means I was calling for an increase of (122/878)= about 14% over five months, which (normally) is a fairly aggressive call, especially when most "experts" were worrying about massive, 1930s-style deflation in January.

Instead of getting the 14% in five months, instead gold only went up about half that, i.e. a little more than 7%. So that was still a strong move, especially in the context of plenty of people warning of terrible deflation.

Nonetheless, I foolishly said that if gold didn't break $1,000 by summer, then I didn't know what I was talking about. What happened is that I really thought gold would be much higher than $1,000 by now, and so I (thought) I was building in a big cushion by only saying $1,000.

Looking back, I can reconstruct what I believe was my downfall: At the time, there were analysts and even some Congresspeople who were criticizing the banks for sitting on all of the TARP money and Fed-related bailouts. The idea was, "Why are we giving you hundreds of billions, if you're not going to start making new loans?"

So I was confident that those excess reserves would soon be flowing into the hands of the public, and that broader monetary aggregates like M1 and M2 would be growing rapidly through the first half of 2009.

I was (of course) wrong. For some reason, I actually took the politicians seriously when they said they were going to do something to "fix" the economy (i.e. pressure banks to lend out reserves).

First, let me give myself a break. At the time of the call, gold was about $878 (I'm just eyeballing the charts from Kitco, so I might be off a bit). Right now, gold is trading at about $942, using the same metric (London Fix).

So that means I was calling for an increase of (122/878)= about 14% over five months, which (normally) is a fairly aggressive call, especially when most "experts" were worrying about massive, 1930s-style deflation in January.

Instead of getting the 14% in five months, instead gold only went up about half that, i.e. a little more than 7%. So that was still a strong move, especially in the context of plenty of people warning of terrible deflation.

Nonetheless, I foolishly said that if gold didn't break $1,000 by summer, then I didn't know what I was talking about. What happened is that I really thought gold would be much higher than $1,000 by now, and so I (thought) I was building in a big cushion by only saying $1,000.

Looking back, I can reconstruct what I believe was my downfall: At the time, there were analysts and even some Congresspeople who were criticizing the banks for sitting on all of the TARP money and Fed-related bailouts. The idea was, "Why are we giving you hundreds of billions, if you're not going to start making new loans?"

So I was confident that those excess reserves would soon be flowing into the hands of the public, and that broader monetary aggregates like M1 and M2 would be growing rapidly through the first half of 2009.

I was (of course) wrong. For some reason, I actually took the politicians seriously when they said they were going to do something to "fix" the economy (i.e. pressure banks to lend out reserves).

What to Do if an Infant or Toddler Is Choking

The other day my four-year-old was choking on some orange slices for about 2 seconds, but those were a terrifying 2 seconds. So I decided to banish my fears through knowledge, and refreshed my memory on CPR for little guys. The below video is about 8 minutes, but it's really good. (You also have to sit through a short commercial in the beginning.) Even if you've read up on how to do these techniques, it's good to see this guy do them on the mannequins, to get an idea of how hard you're supposed to smack their back, or thrust upward in a Heimlich, etc.

Feynman Is Awesome

A flurry of Richard Feynman YouTubes has been hitting the blogosphere, so I'm guessing someone recently uploaded his interview(s). Seriously, if you've never read anything by this guy, you should definitely check out his work; I review the pop stuff here.

Robert Wenzel posted this 6-minute clip that nicely captures what Feynman is all about. (The last 30 seconds is a great finale to the whole clip.) If you like the below, you'll love the rest of his (pop) stuff.

Robert Wenzel posted this 6-minute clip that nicely captures what Feynman is all about. (The last 30 seconds is a great finale to the whole clip.) If you like the below, you'll love the rest of his (pop) stuff.

Krugman Vindicates Jeff Tucker

A while ago, when I was considering working for the Institute for Energy Research, I was talking with Jeff Tucker about climate change. He agreed that it would be a "hot topic" for a while, and so that I didn't need to worry about specializing in the equivalent of Betamax cassettes. Then he said, "Climate change is the Left's War on Terror."

From Krugman's NYT column today (HT2 Bill Anderson)

From Krugman's NYT column today (HT2 Bill Anderson)

Do you remember the days when Bush administration officials claimed that terrorism posed an “existential threat” to America, a threat in whose face normal rules no longer applied? That was hyperbole — but the existential threat from climate change is all too real.

Yet the deniers are choosing, willfully, to ignore that threat, placing future generations of Americans in grave danger, simply because it’s in their political interest to pretend that there’s nothing to worry about. If that’s not betrayal, I don’t know what is.

Sunday, June 28, 2009

An Unexpected Invitation from the LORD

In the first chapter of Isaiah, the prophet recounts his vision of the Lord. He relays standard Old Testament warnings about how the children of Israel are forgetting their blessings, and that their obedience to rituals is not what the Lord seeks. But then Isaiah says:

18 "Come now, let us reason together,"To repeat something I've been saying a lot on this blog, the God of the Jewish and Christian Bible wants you to use your reason. He gave it to you as a gift and tool. This alleged hostility between faith and reason (or science and reason) is spurious. There are atheists and fundamentalists who loudly tell us about this hostility, but they are wrong.

says the LORD.

"Though your sins are like scarlet,

they shall be as white as snow;

though they are red as crimson,

they shall be like wool.

19 If you are willing and obedient,

you will eat the best from the land;

20 but if you resist and rebel,

you will be devoured by the sword."

For the mouth of the LORD has spoken.

Saturday, June 27, 2009

More Conspiracy Theories

The Waxman-Markey bill squeaked through the House. I think it is undeniable that the coverage of Michael Jackson's death helped in its passage. People were distracted by the coverage of Jackson, and so not as many called their representatives to complain.

The obvious conspiracy theory suggests itself, especially when you lump in Farrah Fawcett and Ed McMahon. I am not advancing this as a serious theory, but I will say this: If Waxman-Markey squeaks through the Senate later this year, and Paul McCartney dies the night before, I'm gonna be really suspicious. (And if you throw in Jaclyn Smith and Burt Ward the same week, I will smell a rat for sure.)

The obvious conspiracy theory suggests itself, especially when you lump in Farrah Fawcett and Ed McMahon. I am not advancing this as a serious theory, but I will say this: If Waxman-Markey squeaks through the Senate later this year, and Paul McCartney dies the night before, I'm gonna be really suspicious. (And if you throw in Jaclyn Smith and Burt Ward the same week, I will smell a rat for sure.)

IER Calls for End to All Energy Subsidies

The Washington Post recently sounded very free market in its objections to subsidies for "clean coal." An IER commentary says:

I know there are numerous other sins of which IER has been accused, but I hope "you should officially call for an end to all subsidies" now comes off the list.

When coal is concerned, the Post recognizes how the incentives Members of Congress face lead to troubling results. The Post’s editors should remove their blinders to examine how their concerns about coal subsidies apply equally to the renewable subsidies the Post supports.

The Post should join the Institute for Energy Research and call for an end to all energy subsidies. That would at least make them intellectually consistent.

I know there are numerous other sins of which IER has been accused, but I hope "you should officially call for an end to all subsidies" now comes off the list.

Is the Dollar Doomed?

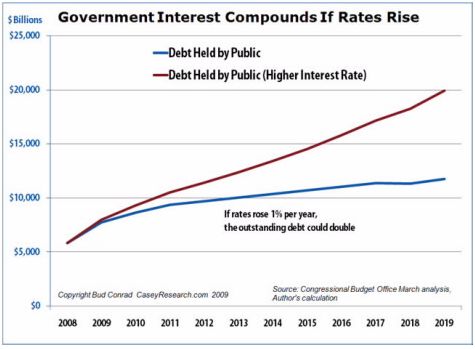

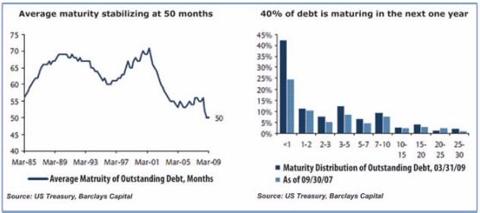

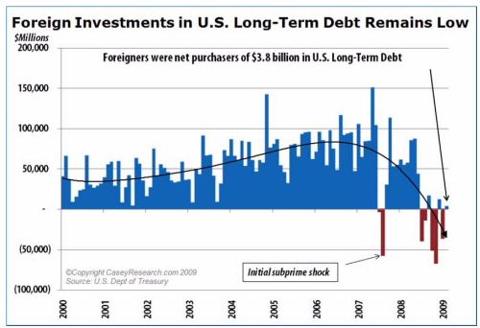

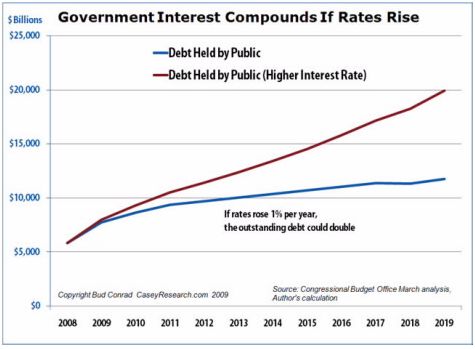

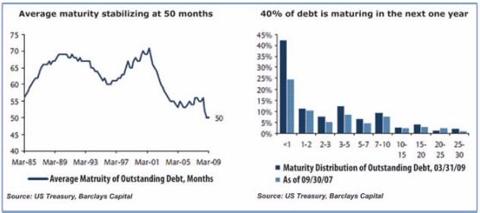

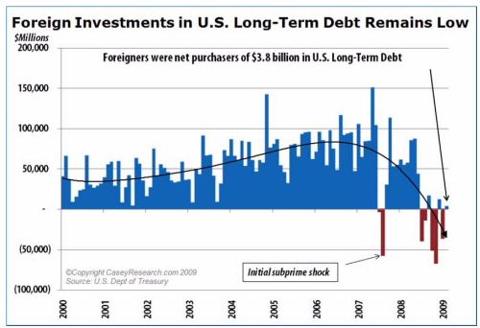

I linked to this Seeking Alpha post already, but even if you followed the link you may not have continued to the charts on Part 2. (Tim Swanson had stressed this in his original email to me.) Check these out:

We all knew the fiscal situation was bleak, but I didn't realize just how bleak.

In related news, the WSJ reported yesterday: "China will push reform of the international currency system to make it more diversified and reasonable, and to reduce excessive reliance on the current reserve currencies, the People's Bank of China said Friday." We all know what that means:

That part I put in bold is particularly ominous. Sounds a bit like, "Hey, if we're going to tie our economy to the U.S. dollar, we get some say in Federal Reserve policy." It looks like they're making it official.

We all knew the fiscal situation was bleak, but I didn't realize just how bleak.

In related news, the WSJ reported yesterday: "China will push reform of the international currency system to make it more diversified and reasonable, and to reduce excessive reliance on the current reserve currencies, the People's Bank of China said Friday." We all know what that means:

The PBOC comments "fuel concern about reserve diversification undermining the U.S. currency," said analysts at Credit Suisse.

China's central bank said in the annual report that under the proposal, the IMF should "manage part of the reserves of its members" and be reformed to increase the rights of emerging markets and developing countries.

It also urged stronger monitoring of countries that issue reserve currencies. Central banks around the world hold more U.S. dollars and dollar securities than they do assets denominated in any other individual foreign currency.

That part I put in bold is particularly ominous. Sounds a bit like, "Hey, if we're going to tie our economy to the U.S. dollar, we get some say in Federal Reserve policy." It looks like they're making it official.

David Icke: The Turning of the Tide

All right kids, I know I've been laying a lot of video on you lately. A while ago I mentioned the documentary Wake Up Call. By far, the most compelling guy from the clips of that movie, was David Icke.

I just watched Icke's Turning of the Tide, and it is amazing. I don't agree with him on everything, but wow this is an interesting worldview.

Below is the first clip; if you want the rest, go here.

I just watched Icke's Turning of the Tide, and it is amazing. I don't agree with him on everything, but wow this is an interesting worldview.

Below is the first clip; if you want the rest, go here.

Friday, June 26, 2009

JFK: Courage Under Fire?

This just occurred to me: I think the most plausible explanation for JFK's demise is that people who controlled the government took him out. In other words, I think it is crazy to assume that (a) the mob or the Cubans could sneak past the Secret Service and (b) that these same mobsters or Cubans *could then convince the rest of the government to cover up their crime*. Maybe (a) is possible, but no way is (b) possible.

OK, so that means JFK was, in a sense, a prisoner of the presidency. In fact, he had the most bugged and monitored work place of any American. These people watched his every move; they had their guys--who were trained to kill--literally following him around 24-7. Kennedy knows he's crossed these people and they are waiting for the right time.

Then on November 22, Kennedy realizes the motorcade is taking a decidedly unsafe route. Had he been alone, he would have seriously considered making a break for it, or blurting out the names of the key people.

But no, he just smiled and waved, because they had put his wife in the car with him.

OK, so that means JFK was, in a sense, a prisoner of the presidency. In fact, he had the most bugged and monitored work place of any American. These people watched his every move; they had their guys--who were trained to kill--literally following him around 24-7. Kennedy knows he's crossed these people and they are waiting for the right time.

Then on November 22, Kennedy realizes the motorcade is taking a decidedly unsafe route. Had he been alone, he would have seriously considered making a break for it, or blurting out the names of the key people.

But no, he just smiled and waved, because they had put his wife in the car with him.

Not a Fan of Geithner

James Quinn realizes there is some skullduggery afoot (HT2 Tim Swanson). I haven't read the whole thing yet, but so far he's my favorite part:

Part 3 of the plan was the fake stress test conducted by Tim Geithner, his Treasury Department, and the Federal Reserve. The entire stress test was a publicity stunt conducted to provide a false sense of confidence in the largest banks so they could fool investors into pouring billions of new capital into their bankrupt banks. The assumptions used in the stress test were stress free. Unemployment is already higher than the worst case scenario. The stress test time frame ended in 2010. The next wave of mortgage resets and foreclosures will hit in 2011 and 2012.

Government Medicine

I'm not a fan. An excerpt:

The government ruins everything it touches. Many high school graduates are functionally illiterate, even though per pupil funding is much higher now than in previous generations. Despite billions in subsidies over the years, Amtrak continues to lose money. The Post Office, though not an official arm of the government, enjoys a monopoly on first-class mail and is not renowned for its efficiency. And when a comedian wants to illustrate poor customer service, his reference case is the Department of Motor Vehicles.

Why in the world do so many people want to entrust this same government with our health care?

Thursday, June 25, 2009

Was Keynes a Good Investor?

In a post chocked full of interesting tidbits, Scott Sumner reveals that Keynes as an investor got wiped out in 1920 but his father bailed him out. That changes everything, according to Sumner:

Don’t anyone write in and tell me that Keynes made lots of other good investments, because if you’ve got a rich backstop, none of that matters. Here’s what I’d do if Bill Gates was willing to lend me $3.57 billion dollars for a day:Unfortunately, Sumner goes on to argue that if you disagree with him, you support Hitler, or something almost as silly. But overall, still an excellent post. See too his rating of Wilson versus Harding.

I’d go to Vegas and put $5 million on numbers 1 through 34 on the roulette wheel. The odds are roughly 90% I’d win. If I did so, I’d win $180 million on a bet of $170 million. I repay the $3.57 billion and pocket my $10 million dollars and be rich for the rest of my life, clipping coupons. If numbers 35, 36, 0, or 00 came up I’d bet again, this time $100 million on each number 1 through 34. If I won, I’d receive $3.6 billion, repay Gates, and have $30 million dollars to spend for the rest of my life. The odds are nearly 99% that I’d win one of these two bets. Of course if both failed, I’d be in big trouble. But that’s not very likely is it?

What’s the point? If you have a rich backstop it’s relatively easy to come up with investment strategies that will usually (not always) make you look like a genius.) From now on I will never believe anyone who tells me that Keynes was a great investor.

A Note on Mass Emails

It amazes me how many people still do this: If you are sending out a mass email--e.g. "everyone should read this Forbes piece on Obama's health plan!!"--then please put your 3 dozen recipients' email addresses in the BCC field of your email. That way, people's privacy is more protected, and they are not susceptible to someone hitting Reply All just to say, "Wow thanks for sending that!"

In some cases, to show you care and how special people are, it might make sense to let all the recipients of your email see each other. But if the list is more than a dozen, nobody feels special.

In some cases, to show you care and how special people are, it might make sense to let all the recipients of your email see each other. But if the list is more than a dozen, nobody feels special.

Murphy Tells Sacramento Pols How to Extract More From Their Citizens

The video from my April 9 testimony on California tax reform is finally up. No, I do not have a Gorbachev birthmark on my cheek. What happened is that the combination of the TSA's restrictions on carrying good razors, coupled with a poor bathroom lighting situation at my hotel, meant that I didn't realize I had caked blood on my face. Suh-weet.

So anyway, if you go to this link, you can see (portions of) my testimony. (I was the first one in the Morning portion.) If you are super super bored, check out the guy who went after me. He was so in-your-face during the Q&A period that I had to restrain myself from laughing out loud.

So anyway, if you go to this link, you can see (portions of) my testimony. (I was the first one in the Morning portion.) If you are super super bored, check out the guy who went after me. He was so in-your-face during the Q&A period that I had to restrain myself from laughing out loud.

Never Quit

On June 17 Bryan Caplan wrote: "My social intelligence is a lot higher than it used to be. I still wouldn't say that I'm "good with people." But in my youth, I was truly inept."

Five days later, he wrote: "I've got a little toenail fungus. Now that you're done cringing in disgust, let's get to the economics."

Five days later, he wrote: "I've got a little toenail fungus. Now that you're done cringing in disgust, let's get to the economics."

The CBO's Estimate of the Cost of Waxman-Markey...

...was somewhat misleading, as we explain in this opinionated post at IER. An excerpt:

There are several major flaws with the CBO approach, but perhaps the most outrageous example of sleight of hand is the CBO’s focus on after-tax income. Because Waxman-Markey will raise prices more than incomes, households will necessarily become poorer. This will push households into lower tax brackets—and thus have lower tax liabilities to the tune of roughly $8.7 billion. Normal people would consider this to be a downside of Waxman-Markey. CBO is not normal. It considers this $8.7 billion as an addition to total household income—money from heaven!—and goes about celebrating the effect of this policy without saying a thing about the cause.

...

Beyond the absurdity of translating rising prices into a benefit for households—on the basis that poorer people pay less in taxes—the CBO’s treatment of income tax revenues is inconsistent with its treatment of carbon allowance auction receipts. The CBO study acknowledges that households will pay higher energy prices partly because businesses will “pass on” the cost of buying emission allowances. But CBO didn’t include this component as a net cost to households, because the government could spend the auction receipts and thus recycle some of the money back into households.

Wednesday, June 24, 2009

Tempted by the Ring of Power

Robert Wenzel sent me the below email, in reference to his hard-hitting financial P.I. site. (He sends me a candy bar every time I use that description.)

I knew this would eventually happen. See, what the clever elite do is, they identify all the really really ambitious and talented people.

And then they buy their silence.

Now I can't prove the following, of course, but it seems entirely plausible to me: Suppose that Ben Bernanke knows beforehand what his policy decision is going to be; that it is "exogenous" to the central banker, if you want to adopt the terminology of the fancy model builders. And then Bernanke's actual job is to come up with a big production (and he has many employees, remember) to justify what he's doing.

Here's a pop quiz, and hopefully we'll get some big gun like Scott Sumner to chime in. (Scott is at that awkward state in his blogosphere career where he has to "participate" in podunk sites like mine, just to keep trying to bump his name recognition beyond the tipping point. In that regard, everyone wants to be the next Tyler Cowen. And we hate ourselves for it.)

Anyway here's the quiz: Is there any school of thought right now that claims Ben Bernanke is doing the right thing? The Austrians think his 0% interest rate is insane, and if I'm not mistaken, there are just as many Friedmanites who think Bernanke is inexplicably failing to use the "ammunition" at his disposal. So if the economy is stuck in a rut for 5 more years, both the Austrians and the monetarists will say, "Duh, we told you this would happen if you ignored us."

So is Bernanke following any academic blueprint to success? If not, doesn't that make my hypothesis above more plausible?

This came up as a search today:

""bob murphy" "council of economic advisors"

The search was done by:

national archives and records administration

Are they setting up for some plans we don't know about?

I knew this would eventually happen. See, what the clever elite do is, they identify all the really really ambitious and talented people.

And then they buy their silence.

Now I can't prove the following, of course, but it seems entirely plausible to me: Suppose that Ben Bernanke knows beforehand what his policy decision is going to be; that it is "exogenous" to the central banker, if you want to adopt the terminology of the fancy model builders. And then Bernanke's actual job is to come up with a big production (and he has many employees, remember) to justify what he's doing.

Here's a pop quiz, and hopefully we'll get some big gun like Scott Sumner to chime in. (Scott is at that awkward state in his blogosphere career where he has to "participate" in podunk sites like mine, just to keep trying to bump his name recognition beyond the tipping point. In that regard, everyone wants to be the next Tyler Cowen. And we hate ourselves for it.)

Anyway here's the quiz: Is there any school of thought right now that claims Ben Bernanke is doing the right thing? The Austrians think his 0% interest rate is insane, and if I'm not mistaken, there are just as many Friedmanites who think Bernanke is inexplicably failing to use the "ammunition" at his disposal. So if the economy is stuck in a rut for 5 more years, both the Austrians and the monetarists will say, "Duh, we told you this would happen if you ignored us."

So is Bernanke following any academic blueprint to success? If not, doesn't that make my hypothesis above more plausible?

Murphy Talk in the Bahamas

Below is the first of nine YouTubes featuring my recent talk for the Nassau Institute. I don't want to be obnoxious, so I'm not embedding all the windows here. If the below sample turns your fancy, then go here to watch the rest. (You may have to click the arrow to open "--> More From RickLoweBahamas".)

Murphy Presentation on Energy Markets

At the risk of letting my immodesty show, I must encourage you to check out this presentation on energy markets. It was the 4th lecture of the day at the North Dakota Policy Council, and they just recently added it to the player. They did a good job interspersing shots of my Power Point slides.

(Remember, when you first click on a speech, the wheel spins for a good minute or two. But then it's not too choppy.)

(Remember, when you first click on a speech, the wheel spins for a good minute or two. But then it's not too choppy.)

Tuesday, June 23, 2009

Politics as Pro Wrestling

Have you heard of the antics in the New York State Senate? It is hilarious. Someone (I think the governor?) called the hijinks and the goings-on a "circus," but I think pro wrestling is a better analogy.

And you know who the most ridiculous people in pro wrestling are? It's not the wrestlers, who after all are pretty above average in many respects and are very entertaining. No, the most ridiculous people are the announcers. So to continue the analogy...

And you know who the most ridiculous people in pro wrestling are? It's not the wrestlers, who after all are pretty above average in many respects and are very entertaining. No, the most ridiculous people are the announcers. So to continue the analogy...

"Wake Up Call"

Someone whose opinion I respect told me to watch this movie. Are there any sites dedicated to refuting it, the way the 9/11 Truthers have all of their major points "refuted" at a FAQ?

Say what you will about the above documentary, it has by far the highest "crazy-freaking-claim to sober-sounding-analysis" ratio I have ever seen. If you start watching it, I really encourage you to give it until the part where they discuss the elites' ultimate plan. The claim makes you laugh out loud, it is so ridiculous, but then they show some clips from Fox etc. that make you say, "Wait a minute..." (cue Twilight Zone music).

=========

And the good thing about movies like the above, is that even if it's way off-base, it gets you thinking globally. For example, what if President George W. Bush acted like a cowboy in order to scare foreigners to accepting some major erosion of their liberties? Just as American politicians love to use North Korea and Iran to do whatever they want, by the same token everybody else gets to warn its people, "We need to do this to keep the Americans from Iraq'ing us!"

Say what you will about the above documentary, it has by far the highest "crazy-freaking-claim to sober-sounding-analysis" ratio I have ever seen. If you start watching it, I really encourage you to give it until the part where they discuss the elites' ultimate plan. The claim makes you laugh out loud, it is so ridiculous, but then they show some clips from Fox etc. that make you say, "Wait a minute..." (cue Twilight Zone music).

=========

And the good thing about movies like the above, is that even if it's way off-base, it gets you thinking globally. For example, what if President George W. Bush acted like a cowboy in order to scare foreigners to accepting some major erosion of their liberties? Just as American politicians love to use North Korea and Iran to do whatever they want, by the same token everybody else gets to warn its people, "We need to do this to keep the Americans from Iraq'ing us!"

Monday, June 22, 2009

Hilarious Bush Quote on Fed Chairmen

Someone just sent me this (old) spoof of The Police's "Every Breath You Take," but just watch it for the first sentence.

A Silly Article on Inflation

I still need to say 8 Hail Marys regarding my erroneous gold call, but in the meantime let's have some fun with today's CNBC article on inflation:

I owe my Hillsdale students a refund. I told them that economists learned there could be idle resources and large price inflation during the 1970s. My mistake.

Federal Reserve Chairman Ben Bernanke must find a convincing way to explain why his central bank is in no hurry to raise interest rates even though the economy is stabilizing.Does that strike anyone else as funny? The "must" in that sentence derives entirely from the the writer's decision to go with the official Fed line, rather than those of some outside analysts. Compare to an analog from foreign policy: "Defense Secretary Donald Rumsfeld must find a convincing way to explain why U.S. forces are in no hurry to leave Iraq, even though the country has no WMDs." Wouldn't that have been a bit creepy, even for our press? Yet when the rules are bent for the Fed, it seems natural.

The Fed thinks that with unemployment at a 26-year peak and idle factory space at its highest on record, there is little near-term risk of prices overheating.

I owe my Hillsdale students a refund. I told them that economists learned there could be idle resources and large price inflation during the 1970s. My mistake.

Dino Kos, managing director at the research firm Portales Partners and a former top Fed official, said as long as the weak economy chills demand for credit, the free-flowing central bank cash poses no inflation threat.See above. And my father taught me to never do business with a man named Dino.

Economists polled by Reuters see no chance that the Fed will raise its benchmark short-term interest rate from the current level near zero at this week's meeting.Isn't this disgusting? Seriously, reread that last sentence. What are we, girlfriends with low self-esteem? Lie to me, Ben! Tell me what I need to hear!

That said, the central bank will probably want to nurture hopes that the end of the recession is nearing.

How quickly inflation builds depends on how quickly factories get back to full speed and the job market recovers, as well as whether the Fed can swiftly scale back lending programs and rate cuts.Oh my gosh. Up till now, the CNBC writer thinks he has been negotiating the disagreement between the inflation hawks and the doves, but at this point in the article he just stated matter-of-factly that stagflation is impossible. Stop talking to Dino!

Krugman's Waterloo

Even though he won't act like it bothered him, Krugman has to know he got busted on the housing bubble quotes. Lilburne gives Krugman a li'l burn in this article:

And what about his strawman protests that he didn't cause the housing bubble, much less the Enron scandal or Kennedy's assassination? The man is willfully missing the point. What is damning about these quotes is not that he necessarily caused anything. What is devastating about them is that they expose the intellectual bankruptcy of his economic principles. Those who look up to him like the second coming of Adam Smith should realize that the neo-Keynesian principles that lead him to advocate aggressive interest-rate cuts and mammoth public spending now, are the very same principles that led him to advocate inducing a housing bubble then. He would himself affirm that his economic principles haven't fundamentally changed since then. So the conclusions and policy prescriptions he infers from them are just as wildly wrong now as they were then.

My Most Extreme Gold Call: Hey, this crow's not bad. Tastes like chicken.

I'm still in Florida recovering from my numerous trips. Tuesday morning I head back home (a 10-hour road trip). But an anonymous poster in a recent blog reminded me of this rash statement I made on January 23, 2009:

I don't know why gold isn't a lot higher, frankly. Part of it is the general drop in prices, I think, but that has surprised me. If gold doesn't break $1,000 by summer then I don't know what I'm talking about (at least in this arena).Well, it's officially summer, and gold hasn't broken $1,000. I will do a postgame analysis once I'm settled back home, but for now let me just acknowledge that I didn't know what I was talking about when I fired my mouth off in January.

Murphy vs. (Hernando) de Soto

In this month's Ideas on Liberty, I take on Hernando de Soto's WSJ op ed calling for stricter regulation of derivatives. An excerpt:

Regardless of what caused the crisis, government efforts to regulate derivatives will only lock in undesirable aspects of the current market and ensure that politically connected players reap artificial gains. It is absurd to ask politicians to promote financial integrity and sound accounting. They are the worst violators of these principles on the planet.

The Danger in Macroeconomic Tautologies

Tyler Cowen has been on fire lately. Check out this:

You'll also read many commentators breaking national income into its components of C, I, G, and X-M (consumption, investment, government spending, and net exports) and asking where the growth will "come from" to "drive" the recovery. Of course national income accounting is an identity, so this cannot be a nonsensical question. Yet when the word "drive" is used, we are smuggling in a causal category. There is no guarantee that any particular decomposition of the national income identities the relevant causal components for what will "drive" recovery. How would it sound if you aggregated national income by zip code or county (or household) and asked where the boost to drive recovery would come from? Such an approach might not be on the right conceptual track.That's just beautiful. I have been chafing against this notion of "we need exports and more consumer spending to pull us out the recession" too, but Tyler's ZIP code analogy is better than what I was trying to come up with.

Would North Korea Get Spanked by its Neighbor?

I cannot verify the claims of this FFF piece (HT2AWC), but the author, Carlton Meyer, is a former "U.S. Marine Corps officer who participated in military exercises in Korea." He writes:

If North Korea attacked South Korea, the South Koreans would fight from mountainous and urban terrain which heavily favors defense, and complete air superiority would shoot up anything the North Koreans put on the road. [The North Koreans'] old tanks would not be able to advance through the mountainous border since the South Koreans have fortified, mined, and physically blocked all avenues. North Korean infantry and engineers could not clear road paths while under heavy artillery fire.

The North Korean military could gain a few thousand meters with human wave assaults into minefields and concrete fortifications. These attacks would bog down from heavy casualties and a lack of supply. Thousands of South Koreans would suffer casualties from North Korean artillery and commando attacks. Nevertheless, the North Korean army would not break through and its soldiers would soon starve.

A major North Korean objective would be to kill Americans. This is not difficult as American troops and their families are located at easily targeted bases that would be pummeled by North Korean SCUD missiles. If millions of Koreans start fighting, the 28,000 American troops in Korea would make no difference – only 4,000 are combat troops. Therefore, Americans who truly “support the troops” should demand that they be removed from Korea where they are just pawns who face death should a conflict erupt.

Sunday, June 21, 2009

Austrians: Our Victory Is Complete

Discussing Krugman's racy PIMCO quote, Scott Sumner says:

So the above is refreshingly funny and humble, but then Sumner goes on to say:

Oh Scott Scott Scott. The issue about the PPF is tricky; as Garrison's PowerPoint [.ppt] make clear, the problem of an unsustainable boom is that the low interest rates lead to greater (apparent) investment and consumption. That is physically impossible, which Garrison denotes by showing the economy moving beyond the (sustainable) PPF.

But the real problem is that part I put in bold. This is the primary weakness in all Keynesian (and Chicagoan) demand-management prescriptions. What exactly does the interest rate do in a market economy, according to these economists? Scott's statement is like saying, "I'm not saying the government should stimulate the health care sector, I'm just saying it should subsidize stethoscopes."

In case I'm being too cute: What I'm saying is that the interest rate is a price that allocates investment among projects of different length. It's not merely a lever for "more investment or less?" To lower interest rates, in the hope of spurring total spending while ignoring the distortions among choice of investment projects, would be akin to raising taxes on labor and not realizing this would affect hair salons more than oil rigs.

As everyone knows by now the once kooky and discredited Austrian business cycle model has now become conventional wisdom. Easy money creates bubbles, which inevitably cause depressions when they pop. It’s Greenspan’s fault. Paul and I are still not on board the Vienna express, but we are in an awkward position. (Thank God I didn’t have a blog in 2002!)

So the above is refreshingly funny and humble, but then Sumner goes on to say:

Here’s what I think is a defensible view of what Paul might have meant...The words are mine [Scott Sumner's--RPM], not Paul’s:

“Business investment is tanking. A sharp fall in overall investment can often lead to a depression. The Fed should reduce interest rates...Because tech is so overbuilt, the lower interest rates may not be enough to bring business investment back to normal levels, instead other types of investment and consumer durables will have to pick up the slack. We can expect the housing sector to expand if rates are cut sharply....In the classical model we would then be moving along the investment PPF from less business investment to more housing investment, instead of moving far inside the PPF (as in the 1930s) with less overall investment as the economy tanks. Let’s hope bankers lend money to people who are likely to repay their loans, so that the bankers do not lose hundreds of billions of dollars, and their jobs. Monetary policy has no choice but to proceed on the assumption that we should stabilize the overall macroeconomy, and let the private sector decide where to allocate resources.”

Oh Scott Scott Scott. The issue about the PPF is tricky; as Garrison's PowerPoint [.ppt] make clear, the problem of an unsustainable boom is that the low interest rates lead to greater (apparent) investment and consumption. That is physically impossible, which Garrison denotes by showing the economy moving beyond the (sustainable) PPF.

But the real problem is that part I put in bold. This is the primary weakness in all Keynesian (and Chicagoan) demand-management prescriptions. What exactly does the interest rate do in a market economy, according to these economists? Scott's statement is like saying, "I'm not saying the government should stimulate the health care sector, I'm just saying it should subsidize stethoscopes."

In case I'm being too cute: What I'm saying is that the interest rate is a price that allocates investment among projects of different length. It's not merely a lever for "more investment or less?" To lower interest rates, in the hope of spurring total spending while ignoring the distortions among choice of investment projects, would be akin to raising taxes on labor and not realizing this would affect hair salons more than oil rigs.

What's the Best Way to Short Treasurys?

Von Pepe sends these articles (here and here) on ways to short U.S. Treasurys.

If anyone has free time and a Bloomberg, can you give us some scenarios with current prices? E.g. I'm interesting in statements like: "If you buy this particular put option on 10-year Treasury futures, then on January 2, 2011, so long as yields haven't fallen, you break even. And if the yield goes up by 50 bps, your return is 15%."

In other words, don't just tell me, "The market isn't forecasting serious price inflation." Tell me the specific wagers that are available, given current prices of various derivatives.

If anyone has free time and a Bloomberg, can you give us some scenarios with current prices? E.g. I'm interesting in statements like: "If you buy this particular put option on 10-year Treasury futures, then on January 2, 2011, so long as yields haven't fallen, you break even. And if the yield goes up by 50 bps, your return is 15%."

In other words, don't just tell me, "The market isn't forecasting serious price inflation." Tell me the specific wagers that are available, given current prices of various derivatives.

Random Thoughts on Faith and Reason

* If nothing else, people who go to church once a week are reminded 4 times a month that there exists Truth with a capital T. That fact alone gives otherwise "simple" people a tremendous advantageous over much more clever atheists who subscribe to modern doctrines that deny this.

* The most important question about reality is whether God exists. People often say things like, "Let's put aside our religious differences, and discuss issue X on its own merits." But that's actually very difficult to do in practice, because people's differing assumptions on that fundamental axiom (if you will) have huge consequences. It's sort of like developing Euclidean versus non-Euclidean geometry. Things that are rational and true in a world without any God, are irrational and false in a world with Him. And the reverse holds as well: Atheists consider Christian doctrines one at a time, and each seems not only physically impossible, but also palpably absurd. Yet viewed in the context of the entire Christian worldview, each doctrine fits snugly with all the rest.

* Atheists will sometimes say, "People can't walk on water / come back from the dead / give birth as a virgin...it's against the laws of physics." No they are not! People come back from the dead, all the time. There are shows on The Learning Channel about this. (A kid is ice skating and falls into the lake, he's legally dead for 30 minutes, blah blah blah.) There is absolutely nothing in "the laws of physics" that says it's impossible for a guy to walk on water. For one thing, what if it's frozen? Duh, okay, what if it's not frozen? Well people at Sea World seem to walk on the water all the time; they trained dolphins. Duh, okay, well what about if it's warm and there aren't trained dolphins? Then the laws of physics say... My point is, atheists flippantly overstate the certainty of their position. Another example is when (many of them) say (falsely) that the entire field of biology stands or falls on the theory of common descent.

* When I first read Mises' magnum opus, I thought it was very odd that he titled it Human Action. I thought "Economics" or "The Market" would have made more sense. Yet the older I get, the more I understand why he did it the way he did. (And say what you will about him--I know there are many non-fans who probably read this blog--but the importance of the action axiom never really struck me until I read this Hoppe essay.) Well, one way of viewing the difference between atheists and believers in the LORD of the Bible, is that atheists see behavior of the physical world, whereas believers see God's actions. The Christian's interpretative stance involves "faith" and does not follow from pure reason. Yet by the same token, I will never be able to really prove that other people have consciousnesses the way I experience it. But I sure think the world makes a lot more sense, and I can sure achieve a lot more of my goals, if I interpret bodily motions as human action. (And Christians be careful how you deal with these issues: Yes you do think that a thunderbolt illustrates the will of God, but it doesn't necessarily mean He's angry.)

* The most important question about reality is whether God exists. People often say things like, "Let's put aside our religious differences, and discuss issue X on its own merits." But that's actually very difficult to do in practice, because people's differing assumptions on that fundamental axiom (if you will) have huge consequences. It's sort of like developing Euclidean versus non-Euclidean geometry. Things that are rational and true in a world without any God, are irrational and false in a world with Him. And the reverse holds as well: Atheists consider Christian doctrines one at a time, and each seems not only physically impossible, but also palpably absurd. Yet viewed in the context of the entire Christian worldview, each doctrine fits snugly with all the rest.

* Atheists will sometimes say, "People can't walk on water / come back from the dead / give birth as a virgin...it's against the laws of physics." No they are not! People come back from the dead, all the time. There are shows on The Learning Channel about this. (A kid is ice skating and falls into the lake, he's legally dead for 30 minutes, blah blah blah.) There is absolutely nothing in "the laws of physics" that says it's impossible for a guy to walk on water. For one thing, what if it's frozen? Duh, okay, what if it's not frozen? Well people at Sea World seem to walk on the water all the time; they trained dolphins. Duh, okay, well what about if it's warm and there aren't trained dolphins? Then the laws of physics say... My point is, atheists flippantly overstate the certainty of their position. Another example is when (many of them) say (falsely) that the entire field of biology stands or falls on the theory of common descent.

* When I first read Mises' magnum opus, I thought it was very odd that he titled it Human Action. I thought "Economics" or "The Market" would have made more sense. Yet the older I get, the more I understand why he did it the way he did. (And say what you will about him--I know there are many non-fans who probably read this blog--but the importance of the action axiom never really struck me until I read this Hoppe essay.) Well, one way of viewing the difference between atheists and believers in the LORD of the Bible, is that atheists see behavior of the physical world, whereas believers see God's actions. The Christian's interpretative stance involves "faith" and does not follow from pure reason. Yet by the same token, I will never be able to really prove that other people have consciousnesses the way I experience it. But I sure think the world makes a lot more sense, and I can sure achieve a lot more of my goals, if I interpret bodily motions as human action. (And Christians be careful how you deal with these issues: Yes you do think that a thunderbolt illustrates the will of God, but it doesn't necessarily mean He's angry.)

Saturday, June 20, 2009

Franklin Sanders, the "most dangerous man in the mid-South"

Betsy Hansen, a summer fellow at the Mises Institute, has a good article today at LRC describing the fate of a guy who fought the fiat money system:

Mr. Sanders fought gallantly given the impossible circumstances in which he found himself. He ran a gold and silver bank for more than a decade, serving customers in Mississippi, Arkansas and Tennessee. His hope was to run his business as a truly free bank, such that he would exchange Federal Reserve notes for gold and silver – and here is the kicker – he tried to do that without charging sales tax on the exchanges. It is true, what Mr. Sanders was doing was entrepreneurial suicide, but you have to give him credit for showing courage and tenacity.Last year I met a fairly wealthy personal investor, and one of the handful of people he read religiously was Franklin Sanders aka The Money Changer.

Restitution versus Retribution

One of the areas where I am more advanced--or misguided, depending on your viewpoint--than most of my conventional libertarian colleagues regards prison. Simply put, I think the institution of prison itself is a barbaric, counterproductive relic of State involvement in law enforcement. The typical libertarian thinks that in a just society, only actual aggressors would be imprisoned; no locking up pot smokers or prostitutes.

But I think if you really had a completely privatized world as envisioned by Murray Rothbard, that the very institution of prison would virtually disappear, because imprisoning an aggressor per se is pointless. (And in actual practice, as conducted by States, prisons are great places to turn novice lawbreakers into professional criminals.) If a guy kills somebody, the best way for him to make up for it is to financially compensate the victim's estate. (In the usual case, I imagine insurance companies would do that right off the bat, and so technically the criminal would be paying back the insurers.) Not only is this more useful than having him rot in prison--or doing something dumb like pick up highway litter or make license plates--but psychologically it would also help him atone for his crime and forgive himself.

What's ironic is that even some Rothbardians don't go with me fully on this route. For example, I believe Walter Block has written (and I don't have the cite handy) that if you murder somebody in cold blood, then under libertarian law you have just forfeited your right to life and anybody else can take you out. (I think the train of thought was coming out of his view that it's not theft if you steal from a thief.)

But I think that's totally wrong, and in fact makes the same collectivistic mistake that State "justice" systems make: If you murder someone, then the victim's heirs inherit whatever legal powers accrue from such a crime. And if the victim happened to be a pacifist, he could have clearly spelled out in his will that none of his heirs would be allowed to exact retribution, even if that were the default. For example, even if the prevailing legal code says that if a guy cuts your arm off, you get to cut his arm off in return, then a pacifist could still specify in his will that nobody is allowed to touch his murderer. That "right" belongs to the guy who was murdered, and he gets the most satisfaction out of his property by making a public display of mercy.

These musings were prompted by David Henderson's discussion of the Dante Stallworth case:

But I think if you really had a completely privatized world as envisioned by Murray Rothbard, that the very institution of prison would virtually disappear, because imprisoning an aggressor per se is pointless. (And in actual practice, as conducted by States, prisons are great places to turn novice lawbreakers into professional criminals.) If a guy kills somebody, the best way for him to make up for it is to financially compensate the victim's estate. (In the usual case, I imagine insurance companies would do that right off the bat, and so technically the criminal would be paying back the insurers.) Not only is this more useful than having him rot in prison--or doing something dumb like pick up highway litter or make license plates--but psychologically it would also help him atone for his crime and forgive himself.

What's ironic is that even some Rothbardians don't go with me fully on this route. For example, I believe Walter Block has written (and I don't have the cite handy) that if you murder somebody in cold blood, then under libertarian law you have just forfeited your right to life and anybody else can take you out. (I think the train of thought was coming out of his view that it's not theft if you steal from a thief.)

But I think that's totally wrong, and in fact makes the same collectivistic mistake that State "justice" systems make: If you murder someone, then the victim's heirs inherit whatever legal powers accrue from such a crime. And if the victim happened to be a pacifist, he could have clearly spelled out in his will that none of his heirs would be allowed to exact retribution, even if that were the default. For example, even if the prevailing legal code says that if a guy cuts your arm off, you get to cut his arm off in return, then a pacifist could still specify in his will that nobody is allowed to touch his murderer. That "right" belongs to the guy who was murdered, and he gets the most satisfaction out of his property by making a public display of mercy.

These musings were prompted by David Henderson's discussion of the Dante Stallworth case:

On Thursday night's The O'Reilly Factor, Megan Kelly...expressed outrage at the lenient sentence given to NFL player Dante Stallworth. Stallworth had gotten drunk and killed a pedestrian. He was sentenced to only 30 days in prison, two years of home confinement, eight years of probation, and a lifetime prohibition on driving. Kelly was outraged that he wasn't given more prison time. But she herself pointed out that the family of the man killed favored this sentence because Stallworth had made an undisclosed cash settlement with them. She found the sentence unjust. I think it was profoundly just. Stallworth didn't hurt "society." He killed a particular man and he compensated the man's survivors enough that they favored the leniency. Justice is a matter of making it up to the people you hurt. No amount of money can bring this man back to life. But no amount of prison time can either. How would it be more just to make him go to prison when the survivors of the man he killed don't want that? Far too many people...think justice in the case of such a death necessarily involves prison.Incidentally, I'm not going to get into it here, but please don't assume in the comments that I'm unfamiliar with the principle of deterrence. All I will say is that you can't simply assume that putting murderers in a big building with other murderers necessarily leads to less murder. I'm not sure that it does. There are other, much more civilized, ways of deterring antisocial behavior than use of dungeons.

Friday, June 19, 2009

Roosevelt the Free Marketeer

In a Washington Post article Ezra Klein rips John Tamny for giving a (very dumbed down) Austrian spin on the social function of recessions (HT2PK). Klein concludes:

At this moment, federal spending does not exist in competition with household spending. It's one of the last forces sustaining it. Indeed, the idea that the economy will heal itself if the government only steps out of the way is exactly the thinking that led to the deep recession of 1937. What a pity those lessons haven't been better learned.Look, I understand why Christina Romer can argue with a straight face that declining deficits are bad news in a depression. But Klein has upped the ante here. Now Roosevelt wasn't merely trying to rein in deficits (which after all was his 1932 campaign pledge), but we're saying it was because he believed in laissez-faire?! I guess he learned his lesson when the Supreme Court overturned his unconstitutional attempts to centrally plan the economy, eh? It's funny the different paths some of us take to our free market views.

Being Tough But Fair With My Buddy Krugman

During my three-year stint as a professor, I strove to be "tough but fair." (I think I got that description from the drill instructor from Full Metal Jacket, which in retrospect may not have been the ideal model.)

Anyway, since I have been waterboarding Krugman's articles recently, I feel compelled to pass this one along from August 2005. Whatever else we may think of him, we must admit that Krugman "called" the housing bubble before many commentators (including me).

At this point I really don't know what to think. My inclination is to say that Krugman called for any measures to boost spending, and then realized to his horror that they had unintended consequences, or that he had created a monster. After all, it sure seems as if Krugman advocated a Goldilocks stimulus plan, in which Greenspan cut interest rates just enough to fill the "output gap," but then jacked them up at precisely the right time to avoid an unsustainable boom.

But since I don't subscribe to Keynesian theory, maybe I'm misreading him.

Final note: I learned of this 2005 article from, you guessed it, Bob Roddis. For those who may be discouraged because I apparently post everything Roddis emails me, whereas I have been ignoring you: Don't fret. I mention about 10% of what BR sends me. Sometimes I wonder if he is actually a computer program.

Anyway, since I have been waterboarding Krugman's articles recently, I feel compelled to pass this one along from August 2005. Whatever else we may think of him, we must admit that Krugman "called" the housing bubble before many commentators (including me).

At this point I really don't know what to think. My inclination is to say that Krugman called for any measures to boost spending, and then realized to his horror that they had unintended consequences, or that he had created a monster. After all, it sure seems as if Krugman advocated a Goldilocks stimulus plan, in which Greenspan cut interest rates just enough to fill the "output gap," but then jacked them up at precisely the right time to avoid an unsustainable boom.

But since I don't subscribe to Keynesian theory, maybe I'm misreading him.

Final note: I learned of this 2005 article from, you guessed it, Bob Roddis. For those who may be discouraged because I apparently post everything Roddis emails me, whereas I have been ignoring you: Don't fret. I mention about 10% of what BR sends me. Sometimes I wonder if he is actually a computer program.

Thursday, June 18, 2009

Yet More on Cost/Benefits of Waxman-Markey

This MasterResource blog post repeats much of what I've written elsewhere, but here's a new point I made in response to Silas Barta's criticism on my Mises Daily piece:

In conclusion, the above arguments do not show that the government should “do nothing.” If one accepted the premises of manmade climate change, and the property rights of certain people to be protected from emissions of others, then advocates could still plausibly argue that greenhouse gas emitters should be forced to pay a certain fine per ton of emissions, which would then be funneled into the hands of the aggrieved parties.

However, under no circumstances would the correct outcome be to cap emissions at the level proposed by Waxman-Markey. That would be akin to banning automobile usage, on the grounds that sometimes pedestrians get hit by drivers.

One final point: If the proponents of carbon legislation took the IPCC models (including the economic ones) seriously, and wanted to start penalizing emitters to compensate those damaged by the emissions, then the obvious thing to do would be WAIT and STUDY THE PROBLEM MORE. Even on their own terms, the damages to poor nations will not really kick in until many decades from now. To refine the analogy above, Waxman-Markey seeks to seriously restrict automobile usage now, on the grounds that some pedestrians might be killed by drivers in the year 2100.

What Did Krugman Know About the Housing Bubble, and When Did He Know It?

The plot thickens. If you need to get up to speed regarding Krugman's alleged advocacy of a housing bubble in 2002, see here.

Now then, Bob Roddis (drawing from the Mises.org blog I believe) sent me a Krugman blog post from Oct. 2006. In the post, Krugman is responding to reader questions regarding his NYT column. Check out this exchange:

OK, so (as Roddis pointed out in his email to me) the very best Krugman can now say is that YES he thought Greenspan should engineer a housing bubble, but he shouldn't have let it go on as long as he did.

Already, Krugman is dead in the water. In his most recent denial, he said the Pimco quote wasn't a recommendation, but merely positive analysis. Well, that's not what he said in 2006.

But then the larger question is, did Krugman issue warnings about the housing bubble in, say, 2004? He very well might have, since Krugman has never been a fan of people getting rich from market activities. (I.e. rising asset values would be a prima facie red flag for Krugman, so it wouldn't surprise me if he wrote that "there oughta be a law against this" between 2002 and 2006.)

At the very very least, Krugman should point out where he told Greenspan to pop the housing bubble that he (Krugman) had recommended Greenspan create. (And no cheating--he had to write that advice before everyone else realized it too.)

Now then, Bob Roddis (drawing from the Mises.org blog I believe) sent me a Krugman blog post from Oct. 2006. In the post, Krugman is responding to reader questions regarding his NYT column. Check out this exchange:

Neeraj Mehra, Amritsar, India: Mr. Greenspan has done a disservice to the nation by creating the housing boom. As a layman-observer, that’s the lingering thought I’ve had. Your article reaffirms it.

The question I have is this: Did he do the right thing — acting morally by engineering a housing boom, more as a bridge loan, until something else showed up at the horizon to shore up the economy — because he didn’t have a choice, or did he undertake a path of mere political expediency? And, that’s a question that’s nagging me for a while.

Would appreciate it if you could shed some light.