Saturday, June 27, 2009

Is the Dollar Doomed?

I linked to this Seeking Alpha post already, but even if you followed the link you may not have continued to the charts on Part 2. (Tim Swanson had stressed this in his original email to me.) Check these out:

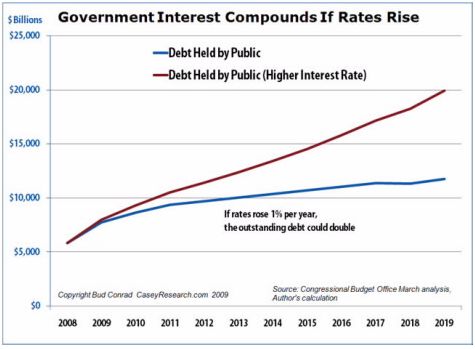

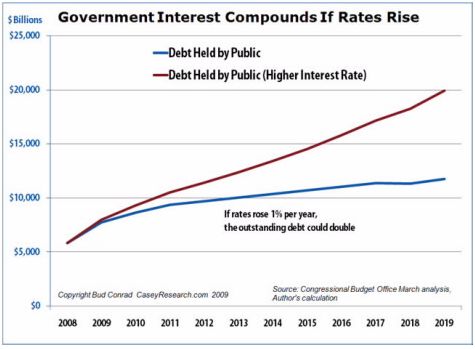

We all knew the fiscal situation was bleak, but I didn't realize just how bleak.

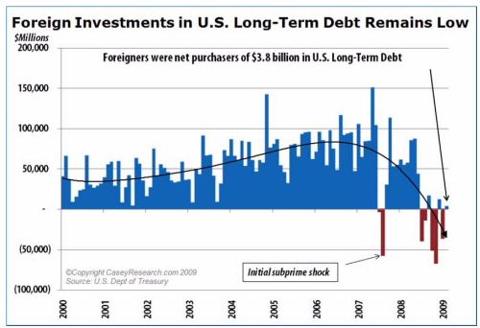

In related news, the WSJ reported yesterday: "China will push reform of the international currency system to make it more diversified and reasonable, and to reduce excessive reliance on the current reserve currencies, the People's Bank of China said Friday." We all know what that means:

That part I put in bold is particularly ominous. Sounds a bit like, "Hey, if we're going to tie our economy to the U.S. dollar, we get some say in Federal Reserve policy." It looks like they're making it official.

We all knew the fiscal situation was bleak, but I didn't realize just how bleak.

In related news, the WSJ reported yesterday: "China will push reform of the international currency system to make it more diversified and reasonable, and to reduce excessive reliance on the current reserve currencies, the People's Bank of China said Friday." We all know what that means:

The PBOC comments "fuel concern about reserve diversification undermining the U.S. currency," said analysts at Credit Suisse.

China's central bank said in the annual report that under the proposal, the IMF should "manage part of the reserves of its members" and be reformed to increase the rights of emerging markets and developing countries.

It also urged stronger monitoring of countries that issue reserve currencies. Central banks around the world hold more U.S. dollars and dollar securities than they do assets denominated in any other individual foreign currency.

That part I put in bold is particularly ominous. Sounds a bit like, "Hey, if we're going to tie our economy to the U.S. dollar, we get some say in Federal Reserve policy." It looks like they're making it official.

Comments:

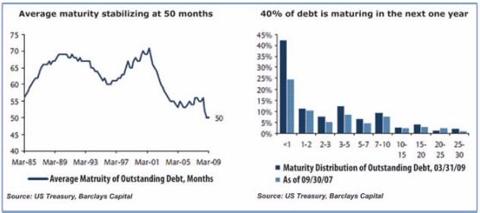

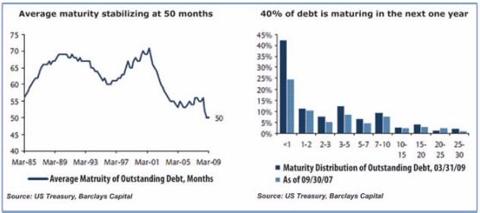

That 40% of debt maturing just makes me cringe.

It is becoming clearer and clearer to me the main reason the I-banks and the hedge funds that did blow up was that they were borrowing short and lending long.

Money and Banking day one: Match your assets and liabilities.

Kaboom. The governemnt is basically "arb'ing' this and it will work until it does not...total roll of the dice.

It is becoming clearer and clearer to me the main reason the I-banks and the hedge funds that did blow up was that they were borrowing short and lending long.

Money and Banking day one: Match your assets and liabilities.

Kaboom. The governemnt is basically "arb'ing' this and it will work until it does not...total roll of the dice.

That chart scared me too, but something is fishy about it. Notice that the more recent bars are higher in the early maturities, but then the later maturities the gap isn't a big deal. So how do the light bars add up to 100%, when the dark bars are clearly much higher summing across all maturities?

Post a Comment

Subscribe to Post Comments [Atom]

<< Home

Subscribe to Comments [Atom]